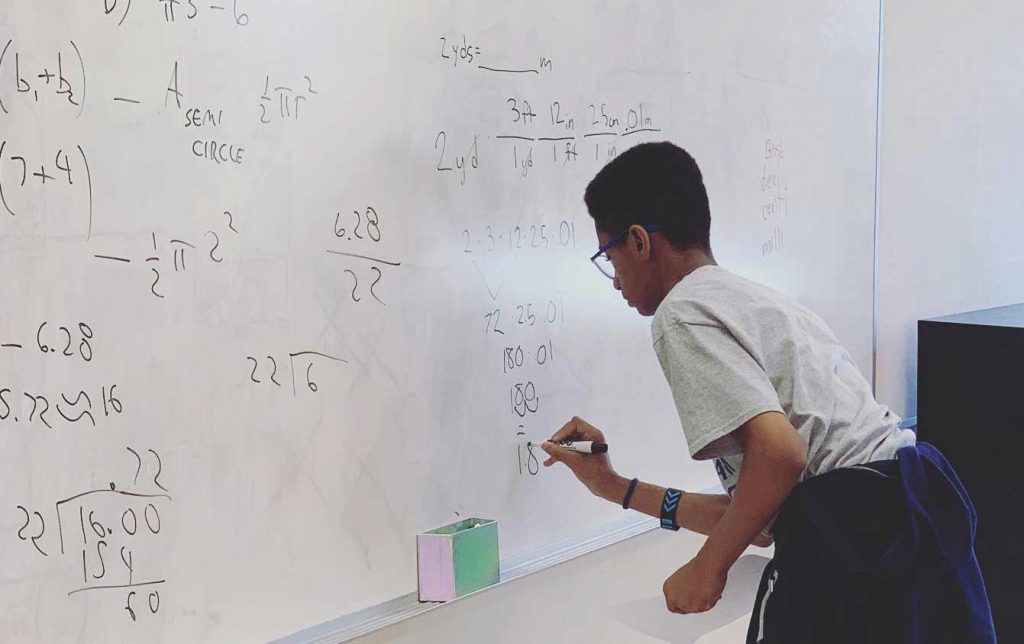

Our mission advances as donor giving allows.

Thank you for giving so our Scholars have the support and resources needed to move to, through, and beyond college.

More Ways to Give

Matching Gifts

Employer Gift Matching

Planned Giving

Securities & Bequests

In-Kind Giving

Shop with Amazon

Need to Give by Check? Send to:

LINK Unlimited Scholars, 17 North State Street, Suite 1250, Chicago, IL 60602

Our impact grows with you.

When you give, our Scholars have what they need to move to, through, + beyond college.

Multiply your corporate impact.

Put the power of your business’s resources behind our proven solution that changes the landscape of Chicago—and the world. Invest in our LINK Scholars as a corporate Partner.

LINK Unlimited Scholars, 17 North State Street, Suite 1250, Chicago, IL 60602 • 312-225-5465 • info@linkunlimited.org